Intralinks

Intro

Intralinks’ data room solutions allow companies to collaborate and share data effectively in M&A deals and any other scenario where complex transactions are processed, and document exchanges are required. This is made possible with advanced software technologies that utilize modern data encryption methods.

In this article, we’ll provide you with a full review of Intralinks’ solutions for businesses, so you can decide whether it’d be the right choice for your company.

Product Screenshots

Contact Details

Year Founded 1900

Website www.intralinks.com

Product Overview

Intralinks Holdings, Inc. is a company that was founded in 1996 in New York City. The company provides inter-enterprise content management and collaboration solutions, specifically by offering virtual data rooms that allow multiple business parties to exchange information and business files in a secure, controlled, and collaborative virtual environment.

In November 2018, SS&C Technologies Holdings, Inc. (Nasdaq: SSNC) acquired Intralinks, for a total acquisition cash value of $1 billion, in addition to $500 million in SSNC shares.

The Intralinks platform is particularly valuable in M&A (Mergers and Acquisitions) projects, where a due diligence process is usually required. It allows for the efficient exchange of large files across advisors.

Intralinks is one of the oldest virtual data room providers in the industry, with a long history that spans over 3 decades. However, Intralinks’ pricing structure is slightly higher than the average in the industry.

There’s no pricing information on the company’s website since you can only get a quote by contacting the Intralinks support team to provide you with a customized package based on your business requirements and budget. You can do that through live chat, phone, or a web form.

Nevertheless, its virtual data room products are available in 3 tiers to suit the needs and budgets of all businesses, including Mergers & Acquisitions (M&As), Intralinks for Alternative Investments, and Intralinks for Banking and Securities.

Intralinks Product Details

Average Users' Ratings

Provider's Features Rating

Data was gathered from our users' reviews and data from G2 and Capterra.

Intralinks Pricing

Intralinks pricing will mostly suit medium and large businesses that have larger budgets to spend on projects. Unfortunately, there are no free plans, but you are welcome to try out the free trial before committing to a paid subscription.

As for the Intralinks data room pricing, it starts at $25 per month. More information about the plans can be acquired through the website. Contact a company representative for more details on getting a customized quote.

There are some prices to expect that are available from reviews. The Intralinks VDR pricing for a data room with 0.5 GB storage starts at $600/month, with price increases based on the storage capacity and the period of usage.

Users mention that while Intralinks’ pricing is not cheap, it offers a good cost-to-quality ratio.

Integration Options

Professionals from various industries share that they’ve used Intralinks data rooms to support the exchange of data and documents for complex transactions like acquisitions.

The integrations below make such deals an incredibly secure and streamlined process:

- OKTA Integration Network. With OKTA, users can build ready-to-configure integrations, being able to publish and expedite security reviews to minimize sales cycles and fuel deals. OKTA integrations are pre-built and can be easily created by admins or developers.

- Microsoft ADFS. ADFS is an identity access solution developed by Microsoft to provide single sign-on (SSO). It offers seamless SSO access to protected digital applications or services.

Features of Intralinks

Features and benefits by use case

Bankruptcy and restructuring

With Intralinks data room and Active Directory Integration solutions, managing bankruptcy and restructuring deals is much more efficient. Bankruptcy and restructuring deals are often time-constrained. Not to mention, the massive number of documents involved can be overwhelming.

With VDRPro, parties can focus on selling assets or developing restructuring plans and let the computer software handle the repetitive tasks that would otherwise take hours to execute manually on a daily basis.

Furthermore, VDRPro maximizes the efficiency of debtor-in-possession and asset sales.

Board reporting

Accessing critical top-management files and reports is fundamental for the success of any company. With the Intralinks data room, board members can securely and easily access key information from anywhere in the world with a unique documents ID and a specific upload date. These include meeting minutes, financial statements, and pre-meeting packages.

Since such reports usually contain sensitive, confidential corporate information, it’s a priority to ensure that only the intended people can access them. That’s exactly what an Intralinks data room is capable of achieving.

Business development and licensing

Business licensing deals consume plenty of resources.

Whether licensing is for funding clinical operations, research and development projects, or market expansion plans, minimizing costs and transaction times, keeping information access under good control, and securing future deals are vital.

With Intralinks data room, you’ll be able to identify potential licensing partners, make workflow management agreements, pinpoint out-license product candidates, conduct due diligence, and manage alliances, all through a secure channel that makes unauthorized access or distribution a virtually impossible occurrence.

Initial Public Offerings (IPOs)

Through solid partnerships with some of the world’s leading financial printers, Intralinks provide an easy all-in-one solution for businesses, with full IPO listing and shareholder communications services that make protecting their capital markets transactions easier and more accessible.

Features and benefits by industry

Intralinks has a dedicated set of solutions for multiple industries.

Energy

The Intralinks data room for the energy sector features preset workflows accompanied by real-time insights. Setup is done automatically, and there’s a Zoom integration tool that enables you to conduct due diligence for M&A deals securely from any spot on the globe.

Intralinks also has a dedicated service team for the energy industry. With the company’s innovative solutions for the energy sector, you’ll be able to prevent power failures and organize large documents.

Life sciences

Complex financial transactions are inevitable in the life sciences industry. Whether you run or are part of a pharma, healthcare, medical devices, or biotech organization, Intralinks’ data room solutions can help you be more productive, accelerate licensing, raise capital, and boost your alliances by leveraging a standardized information-sharing system for all parties.

On top of that, Intralinks’ VDRPro will streamline your M&A due diligence process and eliminate cost and time waste.

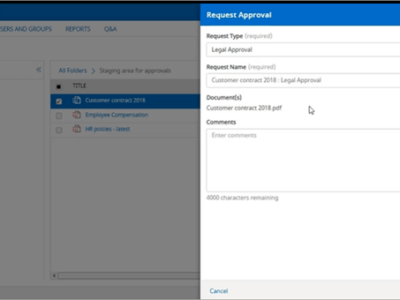

Legal

Legal transactions can be extremely complicated, even the seemingly straightforward ones. Legal teams are usually constrained by tight deadlines, which require fast review and exchange of documents.

Using Intralinks VDRPro, you can centralize the storage of legal documents and only allow access to specific people. It also enables you to pinpoint your most interested buyers.

Intralinks DealVision automatically classifies files and recommends them based on your questions, while AI Redaction allows for a more streamlined workflow with machine learning that seamlessly identifies basic data elements such as addresses and file names.

Frequently asked question

What is Intralinks?

Intralinks is a secure virtual data room platform that enables organizations across industries to easily share, access, and collaborate on documents across multiple organizations.

What is Intralinks used for?

Intralinks is used for securely sharing confidential documents and collaborating on projects with external partners in capital raising, debt financing, M&A due diligence, and deal lifecycle.

Who owns intralinks?

SS&C Technologies own Intralinks.

How much does Intralinks cost?

Intralinks cost isn’t available on the official website. Contact the provider to request a quote.

Users’ reviews

More Reviews

Best ways to start work with the Intralinks VDR

1.Start work

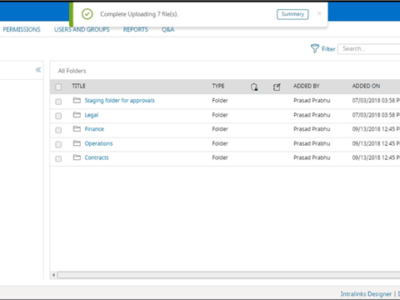

Ensure that deal documents are organized and can be accessed easily beforehand

2.Manage the process

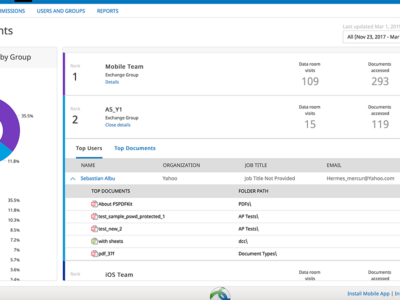

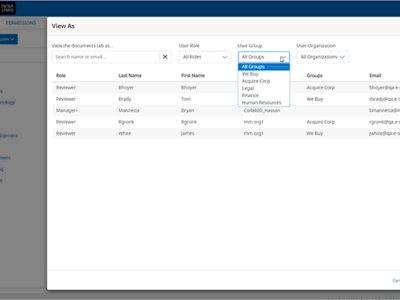

Analyze and manage files with advanced AI tools. Generate detailed reports. Check how your data room will appear to other uses with the View as Other User function. Control access to files and edit permissions. Retract documents with information rights management using the one-click Unshare feature

3.Customize

Customize your files with watermarking

4.Effective collaboration

Effectively and securely invite other users in a streamlined fashion. Name and upload large numbers of files and folders efficiently with a simple drag-and-drop function. Import and assign questions effortlessly with Q&A integration

Not sure about your choice? Then see all providers

Go to providers Leave your review

If you’re looking for an advanced provider, Intralinks is not for you. I was fairly disappointed with how few features are there. For the price they ask you to pay, you deserve to get a way better solution. This data room might feel enough for those who don’t need many functions, but I personally don’t like it.

Overall, Intralinks is fine. We’re using it as an insurance company, and we’re working with lots of quite old-school corporations. So it’s good for us that most of our customers know Intralinks and trust this provider. However, I, personally, feel like I’m lacking some tools.

My company works in the finance industry, and my clients, obviously, want to feel secure. So I chose Intralinks because everyone seems to know it.

It’s a good data room with all the features needed for due diligence. I don’t know how well it will work for bigger needs, but I use it to just exchange information with my partners and clients and for internal data maintenance. The service is always available, and I’m satisfied with it.

To be honest, I picked this provider as the only one I’ve ever heard about. I am not aware very well about all the vendors out there, but Intralinks seems to do the job for me.

I decided to try Intralinks because it’s an old and, I guess, trusted provider. Yet, I was disappointed because I didn’t get all the features I needed, and the cost was high.

We are using Intralinks VDR as a financial company, and this provider fits us well. We have many reputable companies among our customers, and they appreciate us using the data room they know for eternity. And in general, it is very easy to use and offers all the necessary features.

As well as many other Intralinks reviews suggest, I have to say that even though this provider offers great service, it is in fact overpriced. It’s not that we can’t afford it. We were using Intralinks for years. But as more affordable options arrived, it is logical to switch to them.

Intralinks dealspace has an intuitive interface and all the features our company needs. It might be a bit overpriced, but its vast experience is worth it. However, lately I experience the login page constantly refreshing and not letting me into the data room.

We were using this provider for a couple of years. But due to the Intralinks pricing, we had to switch to another one. Intralinks data room is good and very convenient, but there are cheaper options that are not worse than this provider.

Intralinks dealspace must be one of the oldest providers, and I like this fact. As a law firm, we have to make our customers feel comfortable and confident. So using such an experienced and well-known provider, we show our clients that they can be calm. And in general, the data room is quite good.